University of North Carolina Ashville Athletics

The best way to support UNC Asheville Athletics annually and make an impact on every team is by donating to Bulldog Club, the primary unrestricted scholarship fund of UNC Asheville Athletics. Annual donations made to the Bulldog Club help provide our student-athletes with a championship experience in the classroom and in competition through scholarships, facility enhancements, and programmatic support. Any charitable gift made over the course of the membership year to the Bulldog Club qualifies you to become a “member” for that membership year.

Membership Year:

July 1 - June 30

Qualifying Contributions:

Any charitable gift made over the course of the membership year (July 1 – June 30) to the Bulldog Club fund (formerly known as "Bulldog Athletics Fund") qualifies you to become a “member” for that membership year.

Membership Benefits:

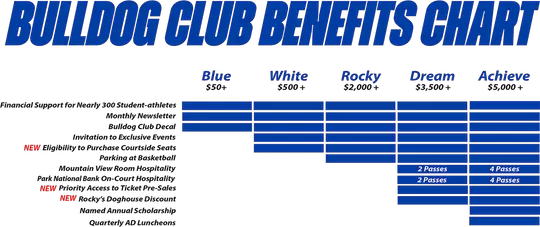

Becoming a member of the Bulldog Club supports all UNC Asheville student-athletes and qualifies you for exclusive benefits. Unless applied to future membership years/campaigns, your contributions made during the current membership year count towards that year's total giving and qualifies you for associated benefits for that giving level (See "Levels & Benefits Chart"). The fair market value of the benefits members receive are subtracted from the tax-deductible portion of the donation and will be reflected as such in the year-end tax receipting.

Ways to Give

Online

Gifts can be made securely through UNC Asheville’s secure online giving site.

Recurring Giving (Online)

A monthly recurring gift is a great way to have an ongoing impact on UNC Asheville’s student-athletes. These consistent gifts provide a critical source of ongoing financial support for the program. You can set up your recurring gift by checking the “recurring” box under the amount section online here.

Check or Money Order

Please make checks payable to "UNCA Foundation/Athletics" and notate the specific area of support in the memo line or in an accompanying letter of direction (i.e. "Bulldog Club", "Women's Soccer", "Men’s Basketball", etc.).

Mail to:

Attn: Bulldog Club

Justice CTRCPO #2600

1 University Heights

Asheville, NC 28804-3251

Faculty and Staff Payroll Deduction

Creating a payroll deduction is an easy way for faculty and staff to make an ongoing impact on our students-athletes.

Complete the payroll deduction form and send it through campus mail to: Advancement Services, CPO #3800

Matching Gifts

Each year, many of our donors extend their giving through generous matching gift programs. These programs are set up by businesses that will match donations made by employees to eligible nonprofit organizations. Ask your employer today if they offer a matching gift program. If so, your employer will provide you with a form to complete and return to UNC Asheville.

Please mail your completed form to:

University Advancement Operations, UNC Asheville, One University Heights, CPO #3800, Asheville, NC 28804

If you have any questions or need support completing your matching gift, please contact Jill Doub, Director of Advancement Services, at (828) 250-3988 or at jdoub@unca.edu

Securities, Stocks and Bonds

By making a gift through shares of stock in a publicly-traded or family business, you can support UNC Asheville and avoid taxes that would result from selling these assets. Below is the information that your financial advisor will need.

Account Title: University of North Carolina at Asheville Foundation

Account Number: 2353-5437

Telephone: 828-232-3773 (Kristi Schofield, Wells Fargo Advisors)

Mailing Address: 190 Biltmore Avenue, Asheville, NC 28801

Name of Receiving Institution: Wells Fargo Advisors

DTC: 0141

For more information, please contact Jill Doub, Assistant Director of Advancement Services, at (828) 250-3988 or at jdoub@unca.edu

Gifts in Kind

Not all gifts to the university are monetary. Sometimes donors have the means to provide goods or services that have financial value but are non-cash. Our staff can help determine the value of your donated goods or services and you will receive gift credit with UNC Asheville. You can learn more on this gifts in-kind form.

To discuss making a gift-in-kind to UNC Asheville, please contact Jill Doub, Director of Advancement Services, at (828) 250-3988 or at jdoub@unca.edu

Donor Advised Funds

When making a gift via a Donor Advised Fund, please direct your gift to UNC Asheville Foundation EIN: 56-6002370. Gifts made to Bulldog Club from a donor advised fund do not qualify for benefits.

IRA or Qualified Charitable Distribution (QCD)

The Bulldog Club is qualified to accept charitable IRA rollovers from donors aged 70½ or older with qualifying IRAs. Additionally, the donor cannot receive benefits for this type of gift. If you are sending payment directly from your IRA, according to IRS regulations, the payment must be a deductible gift in order to be eligible for QCD treatment. Gifts where the donor receives a benefit in return are not deductible per IRS Regulations Code Section 170(l). Please consult your tax advisor for more information. To initiate, please contact your IRA administrator.

Electronic Fund Transfer

Electronic/Wire transfers allow you to transfer money from one bank account directly to another without any paper money changing hands. To learn more about making an electronic fund transfer to UNC Asheville, please contact Jill Doub, Director of Advancement Services, at (828) 250-3988 or at jdoub@unca.edu

Endowments

While cash gifts for current use are vitally important, endowments are the bedrock of all great universities. Once fully funded, your gift produces annual income to support the endowment’s purpose for years to come. Endowments provide certain, steady support in perpetuity.

Funds invested in UNC Asheville Athletics endowments help to offset the scholarship costs for our student-athletes and make a big bottom-line impact for our program.

Please contact Athletics Development staff at BulldogClub@unca.edu or Jill Doub, Assistant Director of Advancement Services, at (828) 250-3988 or at jdoub@unca.edu to learn more about our endowment types and endowment minimums.

Planned Giving

Make a lasting impact by including UNC Asheville in your estate. Visit UNC Asheville’s Planned Giving website to learn how you can make an estate gift that reflects your values and what’s important to you at UNC Asheville, while also fulfilling your financial needs.

Contact the Bulldog Club staff at BulldogClub@unca.edu or 828-251-6894.

.png&width=16&type=webp)